Leverage Your Home's Worth: The Advantages of an Equity Financing

When thinking about financial options, leveraging your home's worth via an equity loan can supply a tactical strategy to accessing extra funds. From flexibility in fund usage to possible tax advantages, equity fundings offer a chance worth exploring for house owners looking for to maximize their monetary sources.

Benefits of Equity Financings

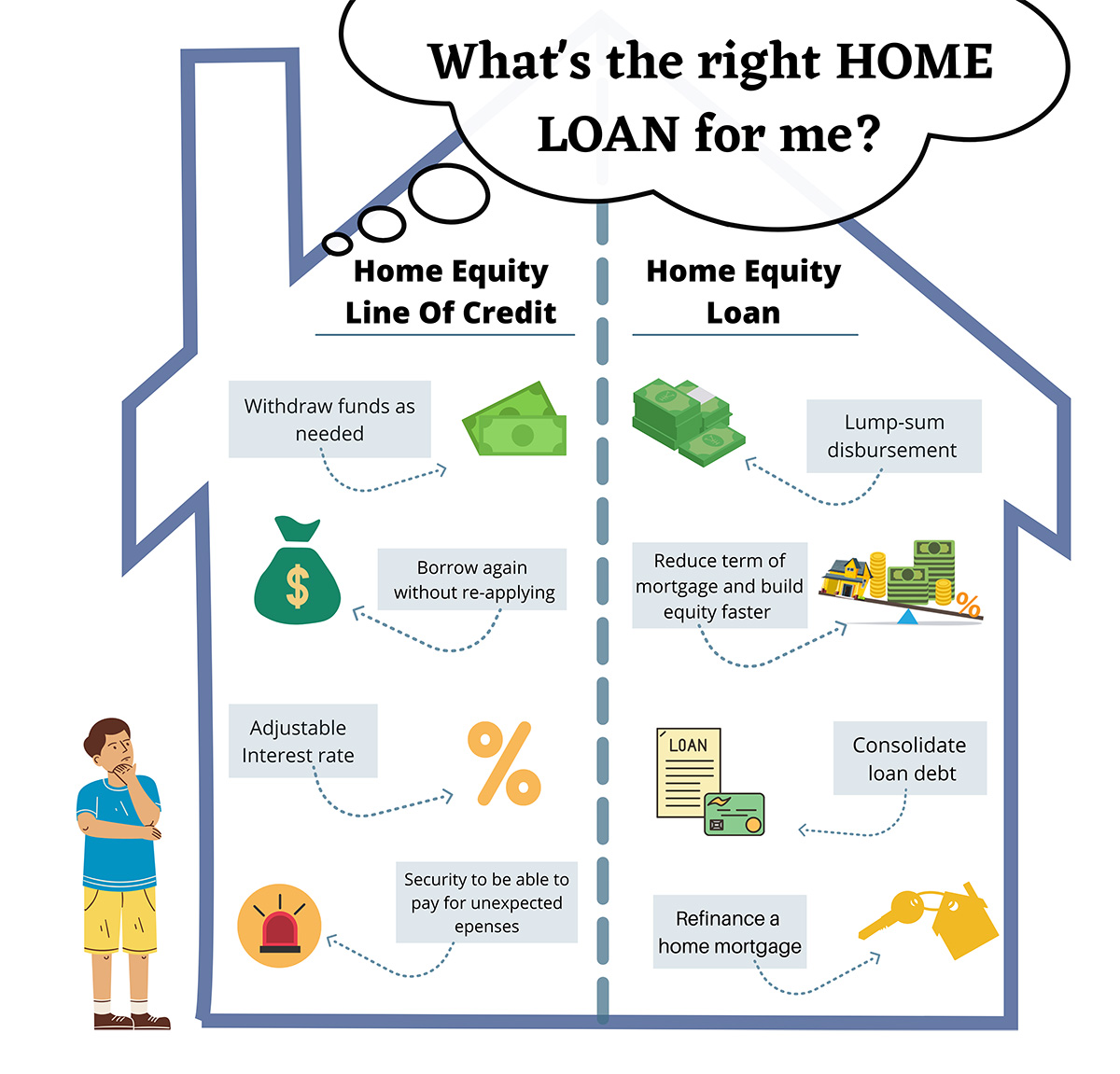

One of the key advantages of an equity loan is the capacity to access a large amount of cash based upon the value of your home. This can be particularly advantageous for home owners who call for a substantial quantity of funds for a particular purpose, such as home renovations, debt consolidation, or significant costs like clinical expenses or education expenses. Unlike other kinds of financings, an equity finance normally offers reduced rate of interest rates because of the collateral supplied by the home, making it an affordable loaning choice for several individuals.

Additionally, equity financings frequently offer a lot more versatility in terms of settlement timetables and funding terms contrasted to various other types of financing. Generally, the capacity to accessibility significant amounts of cash at lower rate of interest prices with versatile payment choices makes equity car loans a beneficial economic device for home owners seeking to leverage their home's value.

Versatility in Fund Usage

Provided the beneficial borrowing terms associated with equity loans, home owners can effectively make use of the flexibility in fund use to fulfill different monetary demands and objectives. Equity finances give property owners with the freedom to utilize the borrowed funds for a wide variety of functions. Whether it's home restorations, financial obligation consolidation, education and learning expenditures, or unexpected clinical bills, the adaptability of equity car loans permits individuals to resolve their financial requirements successfully.

Unlike some other types of fundings that define just how the borrowed money needs to be invested, equity fundings provide borrowers the autonomy to allocate the funds as required. Whether it's investing in a brand-new service venture, covering emergency expenditures, or funding a significant purchase, equity car loans empower home owners to make critical financial choices aligned with their goals.

Prospective Tax Obligation Advantages

With equity fundings, house owners may profit from potential tax obligation benefits that can help maximize their financial planning strategies. Among the primary tax benefits of an equity car loan is the capacity to subtract the interest paid on the lending in particular scenarios. In the United States, for instance, rate of interest on home equity financings approximately $100,000 may be tax-deductible if the funds are made use of to improve the property safeguarding the lending. This deduction can result in significant financial savings for eligible house owners, making equity financings a tax-efficient means to gain access to funds for home restorations or other certified expenditures.

In addition, using an equity loan to consolidate high-interest financial debt may also result in tax obligation benefits. By paying off charge card debt or other lendings with greater rates of interest making use of an equity funding, house owners might be able to deduct the rate of interest on the equity lending, potentially conserving a lot more cash on tax obligations. It's important for homeowners to consult with a tax advisor to recognize the specific tax implications of an equity car loan based on their private circumstances.

Reduced Passion Rates

When discovering the financial benefits of equity finances, one more vital facet to take into consideration is the possibility for home owners to protect lower rate of interest rates - Equity Loans. Equity loans usually use reduced rates of interest compared to various other kinds of borrowing, such as personal financings or debt cards. This is because equity financings are safeguarded by the worth of your home, making them much less high-risk for lending institutions

Reduced rates of interest can lead to considerable cost financial savings over the life of the finance. Even a tiny percent distinction in rate of interest can translate to substantial cost savings in interest repayments. Home owners can use these financial savings to settle the loan faster, construct equity in their homes quicker, or purchase other locations of their financial portfolio.

In addition, reduced rates of interest can improve the total cost of loaning versus home equity - Alpine Credits Equity Loans. With reduced passion costs, homeowners might discover it less complicated to manage their monthly settlements and keep monetary stability. By capitalizing on lower rates of interest through an equity financing, homeowners can utilize their home's value better to meet their economic goals

Faster Access to Funds

Homeowners can accelerate the process of accessing funds by utilizing an equity car loan protected by the worth of their home. Unlike other lending options that might include prolonged approval treatments, equity lendings supply a quicker route to getting funds. The equity accumulated in a home works as security, giving lending institutions higher confidence in expanding credit scores, which improves the authorization procedure.

With equity lendings, house owners can access funds without delay, commonly getting the cash in an issue of weeks. This quick accessibility to funds can be essential in circumstances calling for prompt financial backing, such as home renovations, clinical emergency situations, or debt consolidation. Alpine Credits Home Equity Loans. By taking advantage of their home's equity, property owners can promptly deal with pushing financial requirements without prolonged waiting periods usually connected with various other kinds of fundings

In addition, the streamlined process of equity lendings converts to quicker dispensation of funds, enabling homeowners to confiscate prompt financial investment possibilities or handle unanticipated costs successfully. On the whole, the expedited accessibility to funds with equity financings underscores their practicality and ease for property owners seeking punctual monetary remedies.

Conclusion

:max_bytes(150000):strip_icc()/homeequityloan-e11896bf4ac1475a9806a55f92e0c312.jpg)

Unlike some various other types of fundings that define just how the obtained money ought to be invested, equity fundings supply consumers the autonomy to designate web the funds as needed. One of the primary tax benefits of an equity lending is the ability to subtract the passion paid on the loan in specific circumstances. In the United States, for example, interest on home equity finances up to $100,000 might be tax-deductible if the funds are made use of to improve the residential or commercial property securing the funding (Home Equity Loan). By paying off credit score card financial obligation or other finances with greater interest prices utilizing an equity financing, house owners might be able to deduct the rate of interest on the equity loan, possibly saving also more money on taxes. Unlike various other funding alternatives that may include lengthy approval treatments, equity loans supply a quicker route to getting funds

Comments on “Just How Home Equity Loan Can Finance Your Following Big Job”